- Quickbooks payroll service cost full#

- Quickbooks payroll service cost software#

- Quickbooks payroll service cost trial#

- Quickbooks payroll service cost plus#

The first six months are offered at a 20% discount.

Quickbooks payroll service cost plus#

Quickbooks payroll service cost software#

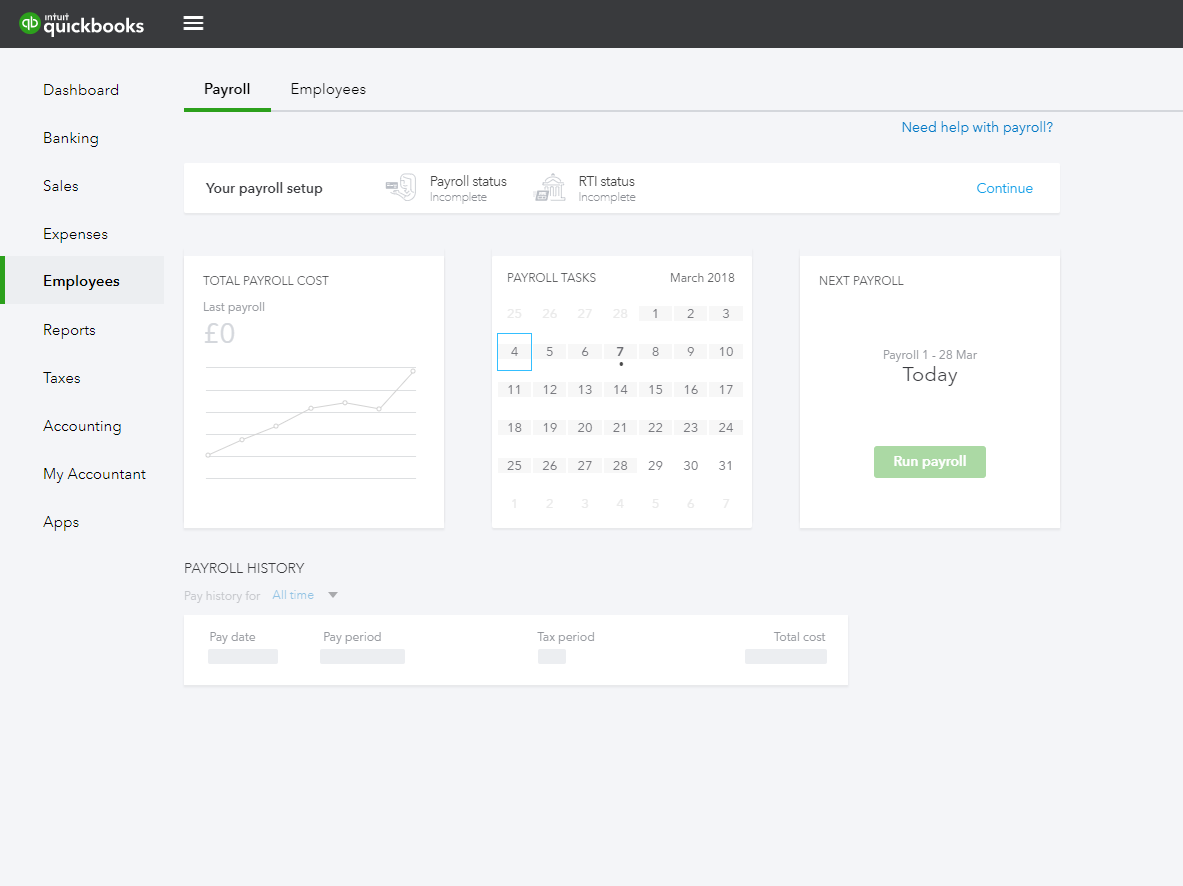

Opting for a plan with accounting software also gives you the ability to track income and expenses, maximize tax deductions, run reports and send estimates. Every time you run payroll, all of the info – including check amounts, state and federal taxes, and deductions – automatically downloads into your QuickBooks accounting software. If you're looking for both accounting software and a payroll service, pairing the two could be ideal for your small business.

There are online versions, desktop versions and plans that combine QuickBooks' payroll and accounting software. QuickBooks Payroll is available in a variety of service plans.

Quickbooks payroll service cost trial#

Keep in mind that first-time customers are eligible for a 30-day trial on all of these plans, so you can give the software a test-drive before you commit to a monthly or yearly plan.

Quickbooks payroll service cost full#

This range of options makes this software a great option for a wide variety of businesses.īelow, you'll find a full breakdown of the pricing and features for all of QuickBooks Payroll's plans. Several plans combine the company's accounting software and payroll service. Part of QuickBooks Payroll's appeal is that the company offers several plan types at a range of prices. QuickBooks Payroll Pricing, Service Plans and Features

Other reasons we recommend QuickBooks Payroll is its ease of use, employee self-service options, range of payroll reports and one-month free trial. Another feature that makes QuickBooks Payroll a solid choice for small businesses is its integration with QuickBooks' accounting software, which many small businesses already use. The service is available in numerous service plans at a variety of prices, so businesses of any size and budget can find a plan to meet their needs. QuickBooks Payroll is ideal for small businesses because of its flexibility and variety. This review is for small business owners who are considering using QuickBooks Payroll as their payroll service.Īfter conducting extensive research and analysis, we recommend QuickBooks Payroll as our 2021 pick for the best online payroll service for small businesses.You can add QuickBooks' accounting software to each service plan for an additional fee.Service plans for this software range between $29 and $125 per month, plus monthly per-employee fees.QuickBooks Payroll is offered in both online and desktop versions.

0 kommentar(er)

0 kommentar(er)